VA Home Loan Requirements: For many veterans, active-duty service members, and eligible surviving spouses in the United States, homeownership becomes more achievable through the VA Home Loan Program. Established by the U.S. Department of Veterans Affairs (VA), this program provides financial backing to private lenders, enabling borrowers to secure favorable loan terms without the need for a down payment or private mortgage insurance (PMI). Understanding VA home loan requirements is crucial to maximizing this powerful benefit.

This comprehensive guide explains the key eligibility criteria, documentation, property requirements, credit and income standards, and how the VA loan process works. Whether you are buying your first home, refinancing an existing one, or seeking to reduce your mortgage costs, this article will provide all the details you need to navigate VA loan requirements with confidence.

What is a VA Home Loan?

A VA home loan is a mortgage option backed by the U.S. Department of Veterans Affairs. It allows veterans, service members, and certain military spouses to purchase, build, repair, or refinance a home with significant financial advantages.

Unlike conventional loans, VA loans are partially guaranteed by the government, which reduces the risk to lenders. This guarantee enables borrowers to enjoy lower interest rates, limited closing costs, and flexible credit requirements.

Types of VA Home Loans

The VA offers several types of home loans to meet the different needs of borrowers:

- VA Purchase Loan: Helps qualified borrowers buy a home at competitive interest rates without requiring a down payment or PMI.

- VA Interest Rate Reduction Refinance Loan (IRRRL): Also called the VA Streamline Refinance, it allows existing VA loan holders to refinance at a lower interest rate.

- VA Cash-Out Refinance: Allows eligible borrowers to refinance their existing mortgage and take out cash from their home equity.

- Native American Direct Loan (NADL): Provides financing directly through the VA for eligible Native American veterans to buy, build, or improve homes on Federal Trust Land.

- VA Energy Efficient Mortgage (EEM): Allows borrowers to include the cost of energy-efficient improvements into their home loan.

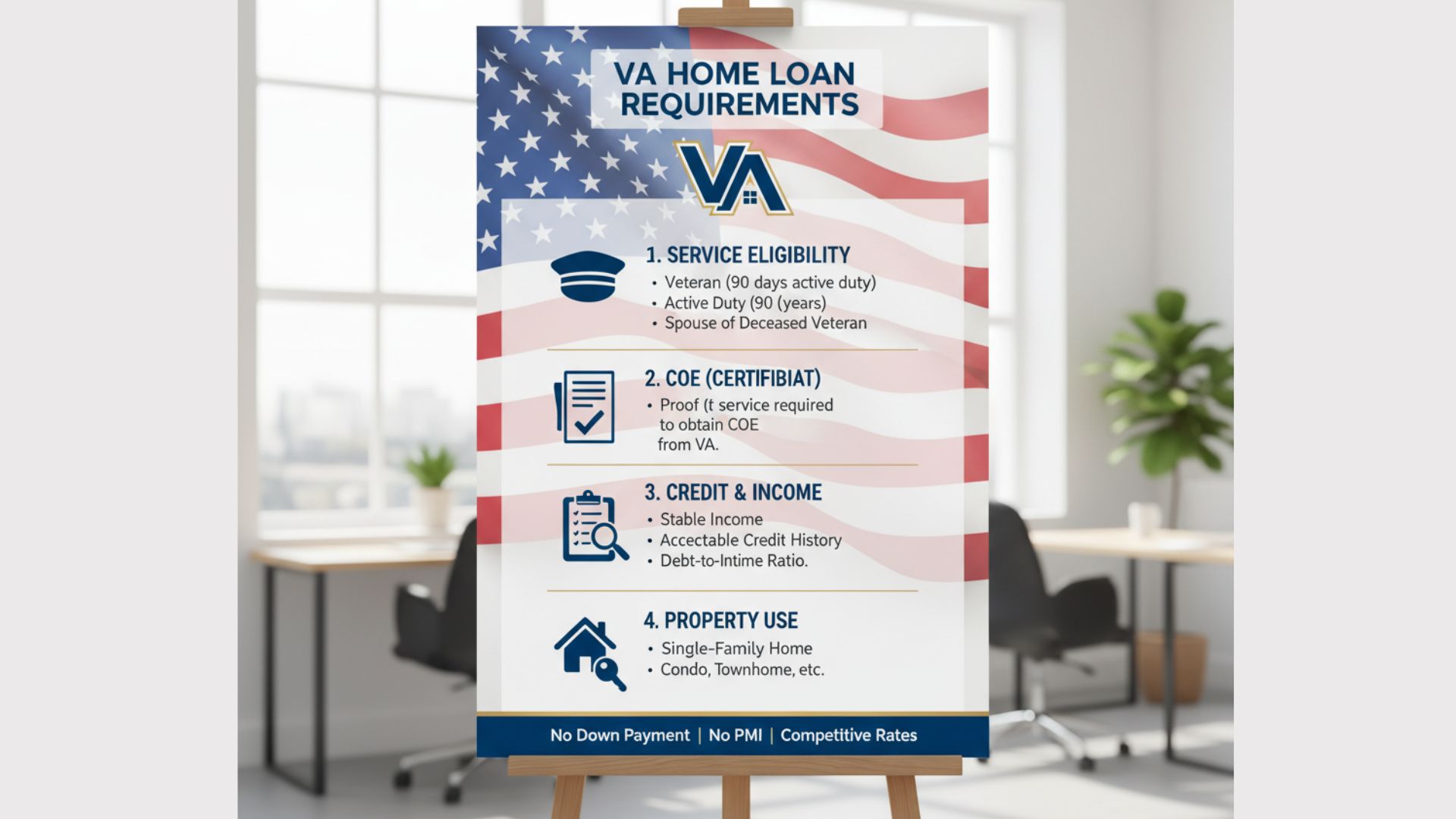

VA Home Loan Eligibility Requirements

To qualify for a VA home loan, applicants must meet military service, credit, income, and property requirements.

A. Service Eligibility

Eligibility depends on your service history and duty status. Generally, you are eligible if you meet one of the following criteria:

- Active-Duty Members: Served at least 90 continuous days.

- Veterans: Served 90 days during wartime or 181 days during peacetime.

- National Guard or Reserve Members: Served for at least six years.

- Surviving Spouses: Eligible if their spouse died in the line of duty or due to a service-related disability.

The VA determines eligibility through a document called the Certificate of Eligibility (COE).

B. Certificate of Eligibility (COE)

The COE confirms to lenders that you qualify for a VA-backed loan. You can obtain it through:

- The VA’s eBenefits portal

- A VA-approved lender

- By mailing VA Form 26-1880 to the VA Loan Eligibility Center

C. Credit and Income Requirements

The VA does not set a specific minimum credit score, but most lenders prefer a score of 620 or higher.

Income requirements focus on residual income—the amount of money left after paying all major expenses. Borrowers must show stable, reliable income to ensure they can afford the monthly mortgage payments.

VA Loan Entitlement

Every eligible borrower receives a certain amount of entitlement, which represents the portion of the loan the VA will guarantee. There are two types:

- Basic Entitlement: Up to $36,000 for loans under $144,000.

- Bonus (or Second-Tier) Entitlement: For loans over $144,000, typically guaranteeing up to 25% of the loan amount.

Borrowers who have used a VA loan before may still have remaining entitlement, depending on whether the previous loan was paid off or the property was sold.

Property Requirements

The property being purchased must meet specific VA Minimum Property Requirements (MPRs) to ensure safety and livability. Key standards include:

- The home must be used as a primary residence.

- It must have adequate living space, sanitation, and structural soundness.

- The property should have access to safe water supply, sewage disposal, and heating systems.

- The home must meet local building codes and zoning regulations.

VA appraisers evaluate these requirements during the appraisal process to determine both the property’s value and condition.

Down Payment and Closing Costs

One of the biggest benefits of a VA loan is the no down payment feature. Borrowers can finance 100% of the home’s purchase price, as long as the sale price does not exceed the appraised value.

However, there are closing costs, which may include:

- Appraisal fees

- Title insurance

- Recording fees

- Credit report fees

- Loan origination fees

The VA limits how much lenders can charge, ensuring borrowers are protected from excessive fees. In some cases, sellers may agree to pay part or all of these costs.

VA Funding Fee

The VA funding fee helps offset the cost of the program for taxpayers. It’s a one-time payment based on the type of loan, down payment amount, and the borrower’s service history.

| Borrower Type | Down Payment | Funding Fee (First Use) | Funding Fee (Subsequent Use) |

|---|---|---|---|

| Regular Military | None | 2.15% | 3.3% |

| National Guard/Reserve | None | 2.4% | 3.3% |

| With 5% Down | 5% or more | 1.5% | 1.5% |

| With 10% Down | 10% or more | 1.25% | 1.25% |

Certain borrowers, such as those receiving VA disability compensation, are exempt from paying the funding fee.

VA Loan Limits

As of 2020, eligible veterans with full entitlement no longer face official VA loan limits. This means there is no maximum amount you can borrow—though lenders will still consider your income, credit, and ability to repay.

Borrowers with remaining entitlement (from a previous VA loan) are subject to conforming loan limits set by the Federal Housing Finance Agency (FHFA).

VA Loan Process Step-by-Step

- Obtain a Certificate of Eligibility (COE).

- Find a VA-approved lender.

- Prequalify for a loan amount.

- Search for a VA-eligible property.

- Sign a purchase agreement.

- Complete the appraisal and underwriting process.

- Close the loan and move into your home.

Throughout the process, working with experienced VA lenders and real estate agents can simplify the steps and ensure compliance with all requirements.

Benefits of a VA Home Loan

VA loans offer a variety of benefits unmatched by most other loan types:

- No Down Payment Required

- No Private Mortgage Insurance (PMI)

- Competitive Interest Rates

- Easier Qualification Standards

- Limited Closing Costs

- Assumable Loans (transferable to another eligible borrower)

Additionally, VA loans provide strong protections against foreclosure and financial hardship, reflecting the government’s commitment to supporting veterans.

Common Misconceptions About VA Loans

- Myth: VA loans take too long to close.

Fact: With modern technology and experienced lenders, VA loans can close as quickly as conventional ones. - Myth: Only first-time buyers qualify.

Fact: You can use your VA loan benefit multiple times. - Myth: VA loans are only for single-family homes.

Fact: You can buy condos, townhomes, or multi-unit properties (up to four units) as long as you occupy one unit.

VA Loan Refinancing Options

Veterans and service members with existing mortgages can benefit from VA refinancing to lower payments or tap into equity:

- IRRRL (Interest Rate Reduction Refinance Loan): Simplifies refinancing to a lower interest rate.

- Cash-Out Refinance: Provides access to home equity for renovations, debt consolidation, or other needs.

Both programs offer flexible terms and no PMI, maintaining the program’s affordability advantage.

VA Loan vs. Conventional Loan

| Feature | VA Loan | Conventional Loan |

|---|---|---|

| Down Payment | Not Required | 3%–20% Required |

| Mortgage Insurance | None | Required if <20% Down |

| Interest Rate | Typically Lower | Higher |

| Credit Score Requirement | Flexible (620 Preferred) | 680+ Preferred |

| Funding Fee | Yes | No |

| Eligible Borrowers | Veterans, Service Members, Spouses | General Public |

This comparison highlights how VA loans are specifically structured to benefit military personnel, making homeownership more accessible and affordable.

Important Links and Information

| Resource | Description | Link |

|---|---|---|

| U.S. Department of Veterans Affairs (VA) | Official website for VA home loan benefits | https://www.va.gov |

| VA Home Loan Program | Details on eligibility, loan types, and forms | https://www.va.gov/housing-assistance/home-loans/ |

| VA Form 26-1880 | Request for Certificate of Eligibility (COE) | https://www.va.gov/find-forms/ |

| Federal Housing Finance Agency (FHFA) | Loan limit information | https://www.fhfa.gov |

| Consumer Financial Protection Bureau (CFPB) | Home loan and mortgage advice | https://www.consumerfinance.gov |

FAQ about VA Home Loan Requirements

Who qualifies for a VA home loan?

You may qualify for a VA home loan if you are an active-duty service member, veteran, member of the National Guard or Reserves, or an eligible surviving spouse. Eligibility depends on your service duration, duty status, and discharge type. Most applicants need to obtain a Certificate of Eligibility (COE) from the U.S. Department of Veterans Affairs.

What is a Certificate of Eligibility (COE), and how do I get it?

The Certificate of Eligibility (COE) confirms that you meet the VA’s service requirements for a home loan. You can obtain your COE:

Online via the VA’s eBenefits portal

Through a VA-approved lender who can request it electronically

By mailing VA Form 26-1880 to the VA Loan Eligibility Center

Do I need a down payment for a VA home loan?

In most cases, no down payment is required for a VA loan, as long as the purchase price does not exceed the home’s appraised value. However, borrowers may choose to make a down payment to lower the VA funding fee or monthly payments.

What credit score do I need to qualify for a VA home loan?

The VA does not set an official minimum credit score. However, most lenders prefer a minimum score of 620 or higher. Some lenders may consider lower scores if the borrower shows strong income stability and low debt-to-income ratios.

Are VA loans only for first-time homebuyers?

No, VA loans are not limited to first-time buyers. You can use your VA home loan benefits multiple times, provided you have remaining entitlement or restore full entitlement by selling or paying off your previous VA-backed property.

Can I use a VA loan to buy investment or vacation property?

No, VA loans are designed for primary residences only. Borrowers must occupy the home as their main residence within 60 days of closing. However, you can purchase a multi-unit property (up to four units) if you live in one of the units.

What is the VA funding fee, and who is exempt from it?

The VA funding fee is a one-time payment required on most VA loans to help cover the program’s cost. The fee varies from 1.25% to 3.3% of the loan amount, depending on the borrower’s down payment and service history.

Borrowers who receive VA disability compensation, surviving spouses, or Purple Heart recipients are exempt from paying this fee.

What are the VA Minimum Property Requirements (MPRs)?

VA Minimum Property Requirements ensure that the property is safe, structurally sound, and suitable for living.

Some basic MPRs include:

Adequate heating, water, and sanitation systems

Safe access and proper drainage

No major structural defects

Compliance with local building codes

How much can I borrow with a VA home loan?

There is no maximum loan limit for veterans with full entitlement. However, your lender will determine how much you can borrow based on your income, credit score, and debt-to-income ratio. For those with partial entitlement, VA loan limits may apply, as determined by the Federal Housing Finance Agency (FHFA).

How long does it take to close a VA home loan?

On average, a VA home loan takes about 30 to 45 days to close, which is similar to conventional loans. The timeline may vary based on factors such as appraisal delays, documentation processing, or lender efficiency.

Can I get a VA loan with bad credit?

Yes, you can still qualify for a VA home loan with less-than-perfect credit. While lenders may prefer a score above 620, the VA’s flexible underwriting guidelines allow consideration of other factors such as income stability, residual income, and payment history.

Conclusion

The VA Home Loan Program stands as one of the most significant benefits offered to American service members, veterans, and their families. Its flexible eligibility standards, zero-down payment option, and competitive rates make homeownership both attainable and sustainable.

By understanding the VA home loan requirements, borrowers can make informed decisions and take full advantage of their benefits. Whether you are purchasing your first home or refinancing an existing mortgage, the VA loan provides unmatched financial support for those who have served the nation.

Ultimately, the key to success lies in preparation—gathering necessary documentation, maintaining good credit, and working with experienced VA lenders. With these steps, the dream of owning a home becomes not just a possibility, but a well-deserved reality.